There are many terms for payment by the employer, i.e. pay: wages, salary, remuneration, earnings, compensation or remuneration.

The amount of pay depends on qualifications, professional experience, industry and profession. In many areas, collective agreements regulate pay. These ensure greater transparency, but only apply to certain sectors or companies.

The most important information at a glance

In Germany, wages are generally paid monthly.

Payment is usually made after work has been performed, i.e. at the end of the month or at the beginning of the following month. The employment contract often states, for example: "Remuneration is due on the last working day of the month" or "Remuneration is paid on the 15th of the following month". The salary is transferred directly to the employee's account. In most cases, a German bank account is required for this, as many employers only transfer to such accounts.

The employee also receives a monthly statement of remuneration, also known as a payslip.

Every person employed in Germany pays taxes and social security contributions on their gross pay. The employer pays half of the social security contributions and bears the full cost of statutory accident insurance.

Your share of the social security contributions is deducted directly by the employer and paid to the relevant health insurance fund.

Further deductions or allowances may appear on your payslip. If you are unsure what these mean, it is best to ask your employer directly.

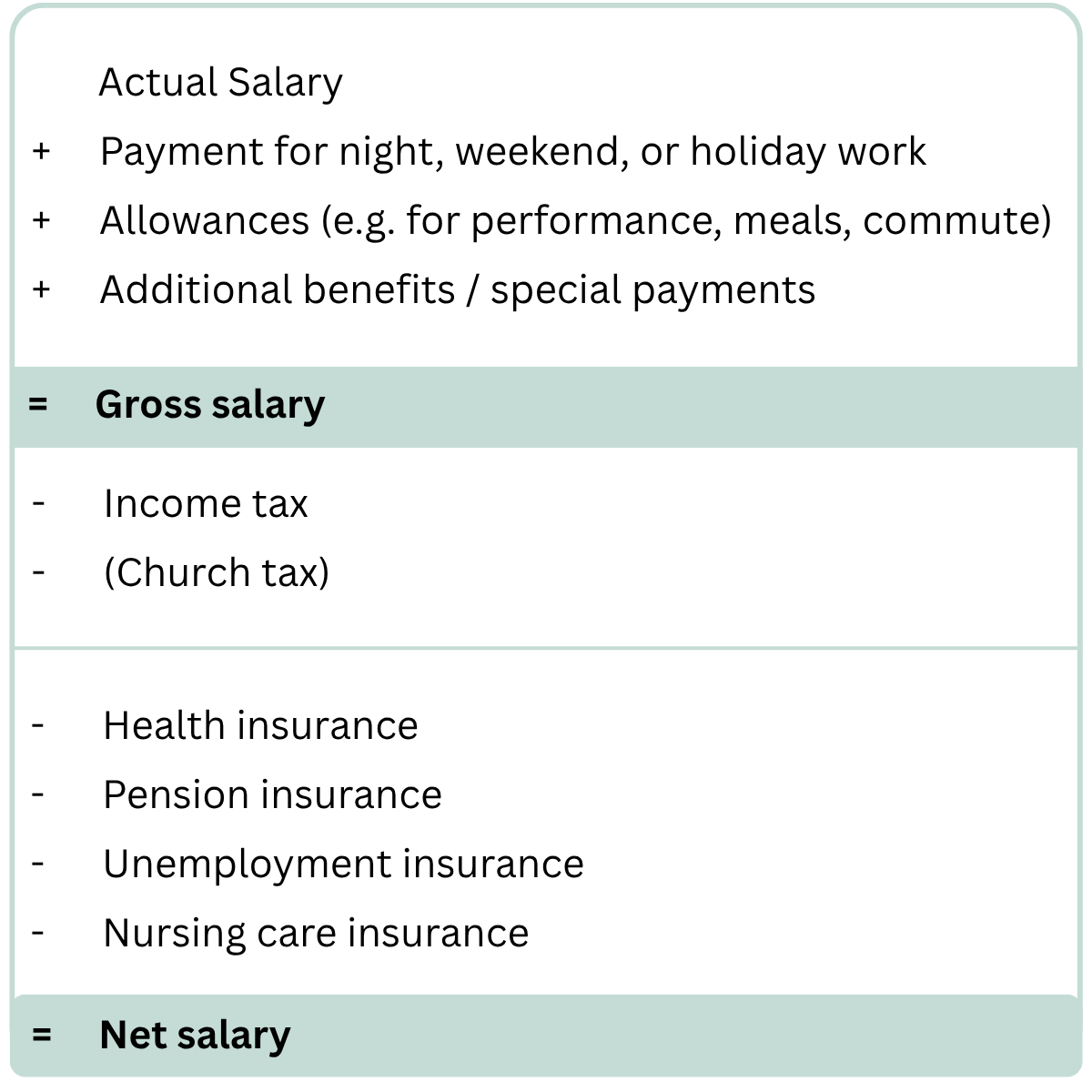

The amount that is finally paid out after all deductions is the so-called net pay.

Note: If you want to know how much of your salary is left over at the end, a gross-net calculator on the Internet can help. To do this, you need to know details such as your tax class or health insurance contribution. The result is a guide value and may vary slightly.

Gross pay

Gross pay is the amount specified in your employment contract or collective agreement. It includes all payments that you receive from your employer.

Gross pay is made up of pay and various bonuses or allowances. For example, there may be bonuses for night work or work on public holidays.

Taxes

Income tax is deducted from gross pay and paid directly to the state.

If you are a member of a church, you also pay church tax, which is also automatically deducted from your salary.

A solidarity surcharge is also levied for employees with very high incomes - for example, over 100,000 euros per year.

You can find more information under Taxes.

Social security contributions

Social security contributions include health insurance, statutory pension insurance, unemployment insurance and long-term care insurance.

Contributions to pension, unemployment and long-term care insurance are set by law. Health insurance, on the other hand, is something you have to choose yourself - the contribution amounts vary depending on the health insurance company. You can find more information on this under Health insurance and medical care.

In the past, all employees automatically received a social security card. Today, a letter with your personal insurance number is sent instead - the so-called insurance number certificate. The social insurance number is important so that your employer can register you with the social insurance institutions.

There are various ways to obtain the number:

- You receive the number when you take out statutory health insurance.

- If you are working in Germany for the first time, your employer can apply for the insurance number for you.

- Alternatively, you can also obtain the number yourself directly from the German Pension Insurance yourself.

If you already have a number, inform your employer. They can call up the social security number electronically from the German Pension Insurance.

The insurance number remains valid for life. You will need it not only for your work, but also if you want to apply for social benefits.

You should therefore keep your proof of insurance number in a safe place. If you do lose it, you can request a new copy free of charge from your health insurance fund or directly from the pension insurance fund.

Further tips on proof of social insurance can be obtained from Deutsche Rentenversicherung.

Information for people who live outside Germany but work in Saxony is available in several languages from Deutsche Rentenversicherung.

The general statutory minimum wage is the minimum wage for employees in Germany. It may not be undercut.

From January 1, 2025, the statutory minimum wage will be 12.82 euros gross per hour.

There are also exceptions to the statutory minimum wage. This does not apply to:

- Trainees

- Interns under certain conditions, e.g. during a mandatory internship

- Young people under the age of 18 who have not completed vocational training

- long-term unemployed persons

- People in voluntary work

- Persons in institutions for participation in working life or in employment promotion measures

In addition, there are so-called collectively agreed minimum wages for certain sectors or activities. These are regulated by collective agreements and are usually higher than the statutory minimum wage.

Payroll accounting - From gross to net

In Germany, the motto is often: "You don't talk about money." Many people therefore do not talk openly about their income.